Bitcoin’s Bull Run: Top Near or Supercycle Ahead?

Exploring the Supercycle Theory and Lengthening Market Cycles

If you’ve been browsing X or YouTube lately, you've probably come across people hyping up a “crypto supercycle” or “lengthening cycles.”

Both terms essentially mean the same thing: crypto will continue to rise over the next few years without facing a major bear market.

Usually, the folks pushing these theories are deep in the euphoria phase. They entered the market a year or two ago, their positions have mostly been in profit, and the news cycle is overwhelmingly positive; it feels like nothing can stop the dream ride that crypto (mostly Bitcoin) is on.

But if you’ve been here long enough, you’ve heard this same narrative before - in 2020, 2021, and even as recently as 2025 from DavinciJ15.

Interestingly, these terms tend to gain popularity right at the end of bull markets.

Why Supercycle?

Multiple analysts agree that Bitcoin is maturing into an asset everyone wants. Governments are accumulating it, countries are passing pro-Bitcoin legislation, ETFs are launching, regulation is becoming clearer, and companies are not just buying Bitcoin - they’re leveraging it on their balance sheets.

Even in this bull market, Bitcoin has outperformed almost all altcoins, and people keep second-guessing whether altcoins are even worth holding.

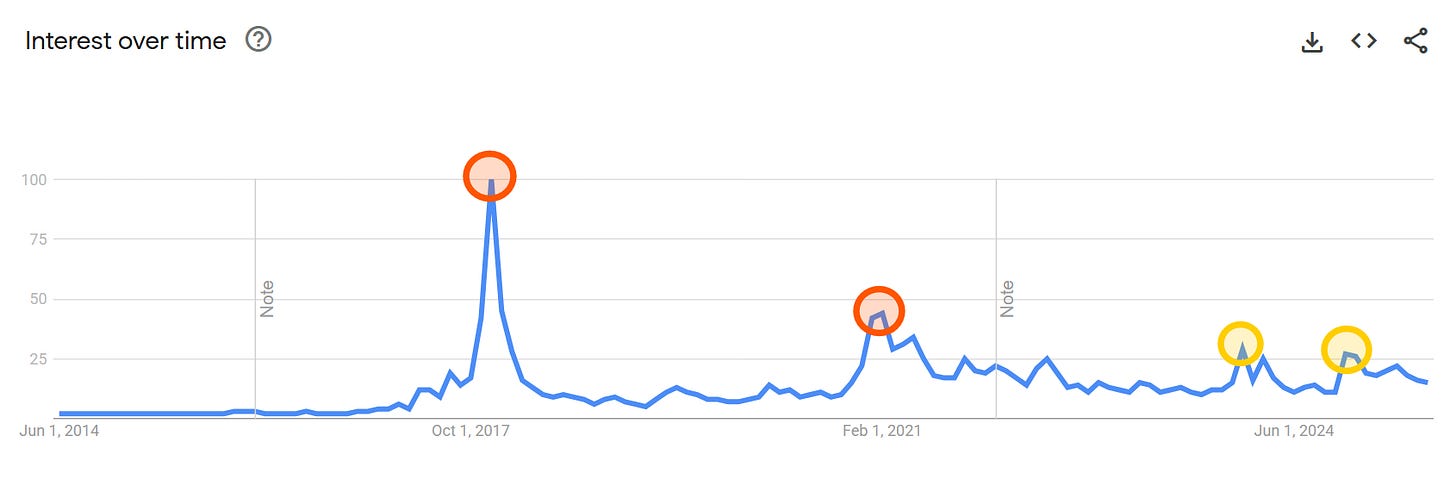

One way to measure retail sentiment is by tracking how often people search for “Bitcoin” or “Crypto” on Google and YouTube.

Surprisingly, search interest in crypto-related terms has dropped back to 2022 and 2018 levels, while Bitcoin is sitting at all-time highs.

Retail interest spiked briefly in January and November 2024, both times when altcoins outperformed Bitcoin in the short term.

But overall, the altcoin market is still weak. VCs are investing far less money, and the focus has shifted to trading strategies, because holding doesn’t seem to make sense anymore (unless we’re talking about Bitcoin).

That’s why analysts are now floating the idea of a “Supercycle”, a market that just keeps climbing, without the brutal drawdowns we saw in 2018 and 2022.

What If… We Do Enter a Supercycle?

If Bitcoin really is in a supercycle this time, here’s what it could look like:

We hit a new local high in July

Consolidation follows until September/October

Then a strong push higher at year-end

When everyone expects a bear market… Bitcoin takes off and hits a blow-off top over $200k in April or May.

This would spark a euphoric phase, with retail piling back in and Bitcoin all over mainstream media. Then comes the “mini bear market” - a 35–40% retracement down to around $100k. That would likely be the bottom of the cycle, around November 2026.

But unlike past cycles, this “bottom” would be brief.

Within a year, Bitcoin could reclaim and smash its all-time high again, kicking off a left-translated cycle from 2026 to 2030.

Prices would surge rapidly for 12–18 months, followed by a slow 2.5-year bleed down - a multi-year bear market that would catch everyone off guard.

In short, it would be crypto’s version of the dot-com bubble: a relentless rally (like 1994–2000 for stocks), followed by an extended period of correction.

What About the Cycles?

Looking at the higher timeframes (1-Week and 2-Week Cycles), we expect the 2-week cycle top within the next 4 weeks, likely by late July or early August.

That’s because the 2-week cycle is now above 85, and the 1-week cycle is reversing from 43.

This combo typically signals a strong price surge - and a potential (local) top.

“Master, show me the most probable Bitcoin topping scenarios!”

Bitcoin will top in…

Keep reading with a 7-day free trial

Subscribe to Strategy Master to keep reading this post and get 7 days of free access to the full post archives.