Crypto Fear Is Normal—Here’s What Comes Next

Shaken by the market? You might be closer to the bottom than you think.

You’re afraid.

The stock market is crashing. The crypto market is dropping. Your tokens are deep in the red.

If that’s you, read on.

You bought altcoins in February because you thought the correction was over.

The truth? You were very close.

Bitcoin (and the broader crypto market) made a weekly cycle low at around ~$77,000 in early March, then started rallying back to the $90,000 area—signaling the beginning of a new weekly cycle.

But then macroeconomic factors kicked in. Bitcoin began consolidating around the $80,000 zone, occasionally moving up or down.

This is driving investors nuts. We don’t know if the trend is reversing or if the bullish structure is still intact.

Or do we?

The above chart depicts the potential outcome for the current Weekly Cycle for Bitcoin.

The red line shows a bearish Weekly Cycle. This scenario assumes we've started a new Weekly Cycle—but that it immediately failed.

That usually means we go below the low of the previous cycle (which already happened when we dropped below $77,000). If this plays out, expect a few months of bearish action, with occasional relief rallies. It could mark the start of a bear market.

The green line shows a bullish Weekly Cycle. This one assumes the new cycle has started, and we’re headed higher. This would’ve been the reality if the macro situation had remained stable over the past few months.

But with the uncertainty in traditional markets…

(More on the most probable ETH scenario at the end)

“Master, I thought this article was about $ETH!”

To understand where Ethereum is headed, you first need to understand where we are in the cycle—and what Bitcoin is telling us.

We're in the third year of the bull market. Historically, this is when altcoins begin to outperform Bitcoin. While BTC dominance is still strong, it’s likely topping soon, as discussed in the previous article.

ETH has had two brutal years against BTC. We're now in heavily oversold territory.

Cycles show the way. Sometimes it's hard to trust them, especially with all the external noise—tariffs, recessions, war—but cycles don’t care. They continue, regardless.

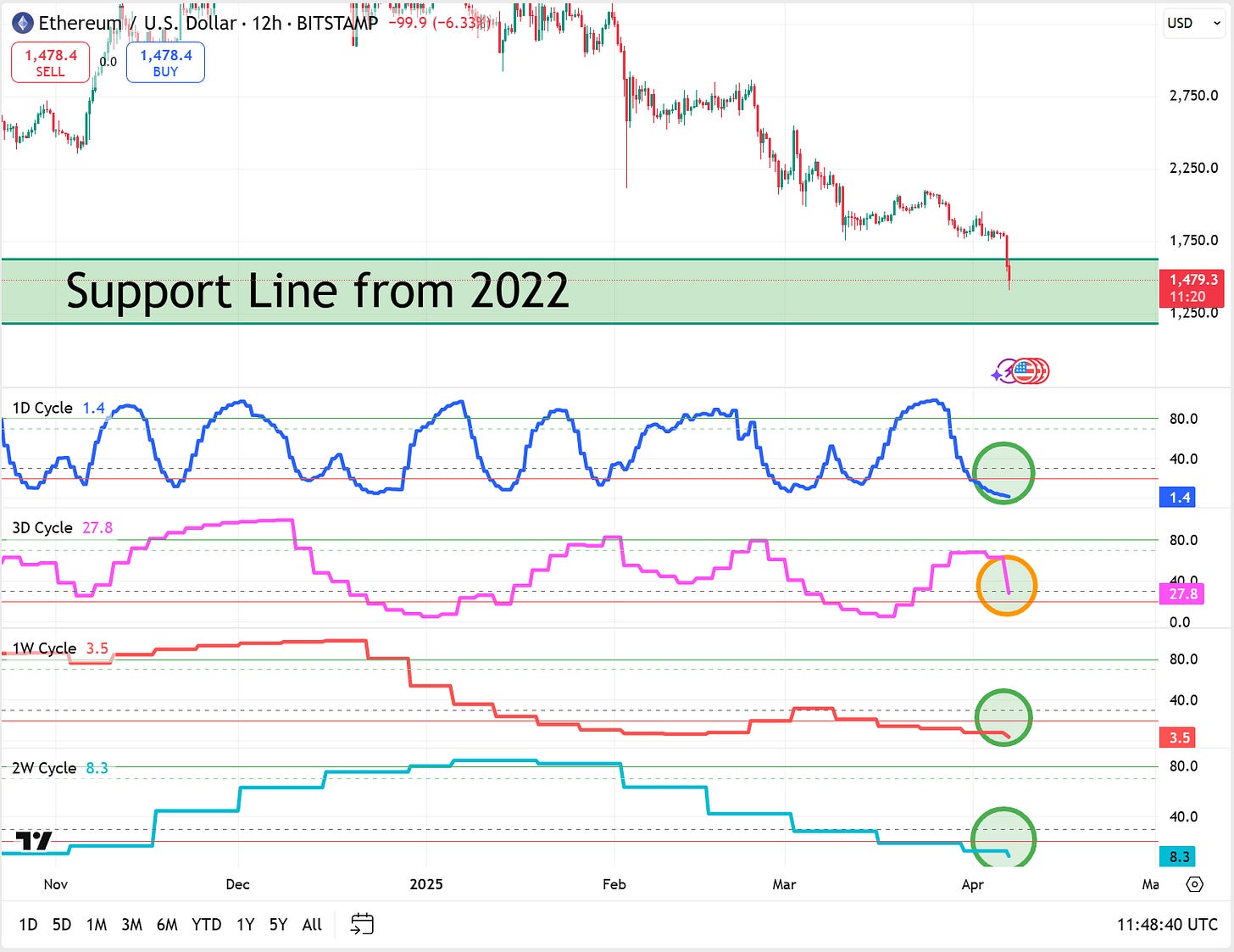

ETH has come “home.”

After two years in a bull market (which wasn’t very bullish for Ethereum), it took just 110 days to reset everything.

Now it’s shaping up to be a generational buying opportunity once again.

“Master, you’re saying ETH won’t drop further?”

There’s always a chance of one final leg down—maybe 10–20%. But that doesn’t change the investment thesis. We’re aiming for prices above $2,000-$3,000.

“Master, the world’s going into recession, and you’re talking about $3,000 ETH?”

Let me explain.

Keep reading with a 7-day free trial

Subscribe to Strategy Master to keep reading this post and get 7 days of free access to the full post archives.