Crypto Signals: Hype, Risk & Real Profit

A No-BS Guide to Navigating the Most Controversial Part of the Market

Bitcoin is reaching its cycle low and gearing up for a bull market. Altcoins are still underperforming, yet everyone around you is hyped about the upcoming “altcoin season.”

Meanwhile, you’re sitting on the sidelines, waiting for that perfect trade—but it never seems to come. Your P&L is bouncing around daily, and everyone on Twitter seems to know where Bitcoin is headed next. But you? You’re still unsure whether to allocate more capital or just wait it out.

Your Telegram is buzzing with notifications:

“Buy $BTC at…”

“Sell for…”

And yet, you're overwhelmed — not just by the volume of signals, but by how unreliable most of them seem.

The chart above shows my trading signals based on the “Small Timeframe” strategy, which is available to all Premium subscribers.

If you’re thinking of following signals—whether mine or someone else’s—there are a few important things to consider:

1. How long has the service been around?

Services that have only existed for a few months are often short-term money grabs.

2. Past performance of the signals

While past results never guarantee future profits, they can give you a good sense of whether a provider is even worth your time—or if their signals can actually help generate side income.

3. The strategy behind the signals

This is by far the most important (and often most overlooked) point.

Back when I started, I was lured by massive percentages on P&L screenshots. “These guys are 4x-ing their capital in one trade? I want that!”

I paid for premium groups, hunted down secret Discord servers, and followed private communities run by YouTube influencers.

And after half a year of doing that, here’s what I learned:

I wasn’t any richer.

I still sucked at trading/investing.

Without signals, I couldn’t make a single move myself.

The Problem

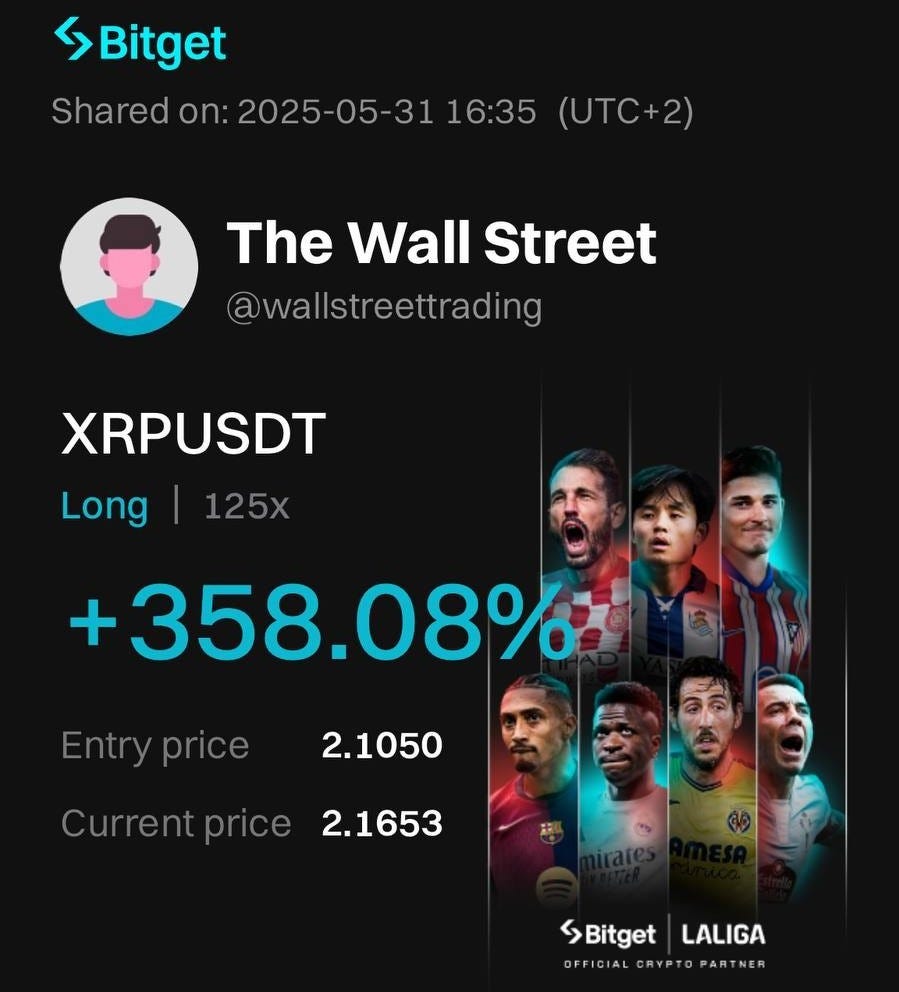

A P&L card showing +358% on a 125x leveraged XRP trade may seem impressive at first glance, but it's incredibly misleading.

With that kind of leverage, even a tiny 0.8% move in the wrong direction results in a total liquidation. You lose your entire position.

And here’s the real deal: most of these trades are made with laughably small amounts, often just $10. So that "358% profit"? It’s only $35.80.

These flashy stats are designed to look like massive success, when in reality, they reflect high-risk gambling.

Worse, they leave out crucial details:

What was the liquidation price?

Was there a stop-loss?

How many losing trades came before this win?

Add to that polished branding—like tying it all to LaLiga, the Spanish football league—and it becomes clear: this isn’t trading. It’s marketing. And it’s dangerous, especially for newer traders.

High leverage magnifies gains, but it also magnifies losses. Real trading success comes from sustainable strategies and solid risk management—not viral screenshots.

After falling for the same hype, I spent two years developing and refining my own trading and investing strategies, which eventually led to the creation of Cycles.

Cycle Signals

The Cycle Strategy is based on one main Cycle Indicator applied across multiple timeframes. Over time, I realized that every timeframe tells a part of the story. But the real value?

It lies in how different timeframes interact with each other.

I identified the best settings for each timeframe—those with the highest price-to-indicator value ratios.

From there, I combined the most informative timeframes into a single, powerful indicator.

Whenever this composite indicator drops below 20, it's usually a strong signal that the asset is near a local bottom. Likewise, I’ve identified timeframe combinations that signal the best moments to exit or sell.

I call this the “Small Timeframe” Strategy, and it's been shared exclusively with my private community.

Unlike basic Telegram signals, Cycle Signals give Premium users access to real indicators directly on TradingView. You can backtest them across any asset.

Look closely at the example above—every single $ENA entry from February 2025 has been profitable.

That means you don’t need to rely on signals. You can apply the Cycle Indicators on your own and develop your personal edge.

In fact, every asset has its own personality. I truly believe you could apply these same indicators to assets like silver, oil, or cacao—and find entry points even better than mine.

What sets the Cycle Strategy apart is that it accounts for human emotion—fear, greed, hesitation, and market momentum. It’s a long-term, sustainable strategy that works across all non-manipulative, tradable assets.

“I already have access to the indicators, Master. Which signals will bring the highest returns?”

Great question. To maximize your returns, focus on these four principles:

Keep reading with a 7-day free trial

Subscribe to Strategy Master to keep reading this post and get 7 days of free access to the full post archives.