Every smart crypto investor wants to see Ethereum explode — because we know that when ETH pumps, altcoin prices usually follow.

Let’s be honest: most of us aren’t holding just Bitcoin — we’re heavy on altcoins. And when Ethereum moves, it drags the rest of the market with it. A high ETH price = a happy portfolio.

ETH recently tapped $2,500, and just when it felt like altcoins were finally outperforming Bitcoin — and our unrealized gains were taking off — the market pushed back.

Cycle indicators still point toward $ETH hitting at least $3,000 — but not before we face one more shakeout.

#1 Price Shakeout

This is the second-best scenario. Shakeouts do exactly what they sound like — they shake investors out of their positions. They make the market look worse than it actually is, leading many to close or forget their positions, lose confidence, or exit the market entirely... only to see it pop back up a month or two later, triggering that classic “I missed the bottom” feeling.

Honestly, it was hard to convince myself to buy Ethereum at $1,600 — but it was way easier to buy again at $1,800 once there was a confirmation of a potential bottom.

The reality? It’s nearly impossible to buy the absolute bottom (not talking luck here, but calculated decisions) — and that’s totally fine.

#2 Time Shakeout

Time shakeouts can be even more brutal. Sure, no new lows are made (though we might retest them multiple times), but also — no new highs.

Investors holding ETH get frustrated and start doing one of two things:

Overtrading — jumping in and out of positions, usually too late to buy and too early to sell.

Chasing volatility — selling ETH to jump into more active coins, only to come back once ETH has already pumped.

This isn’t just an ETH phenomenon — it’s standard behavior across all financial markets.

“Master, enough blurb. Where are we now with ETH?”

We’re in that boring phase. ETH isn’t making new highs, but it’s also not breaking down. It feels like we should look elsewhere.

But in reality? The fun’s just about to begin.

“Alright, but why are you so bullish on ETH?”

Because I’m looking for the safest bet in crypto — a place to park a significant amount of capital while aiming for 80%+ annual returns. Crypto is extremely risky, so my goal is to reduce risk as much as possible while nearly doubling my capital.

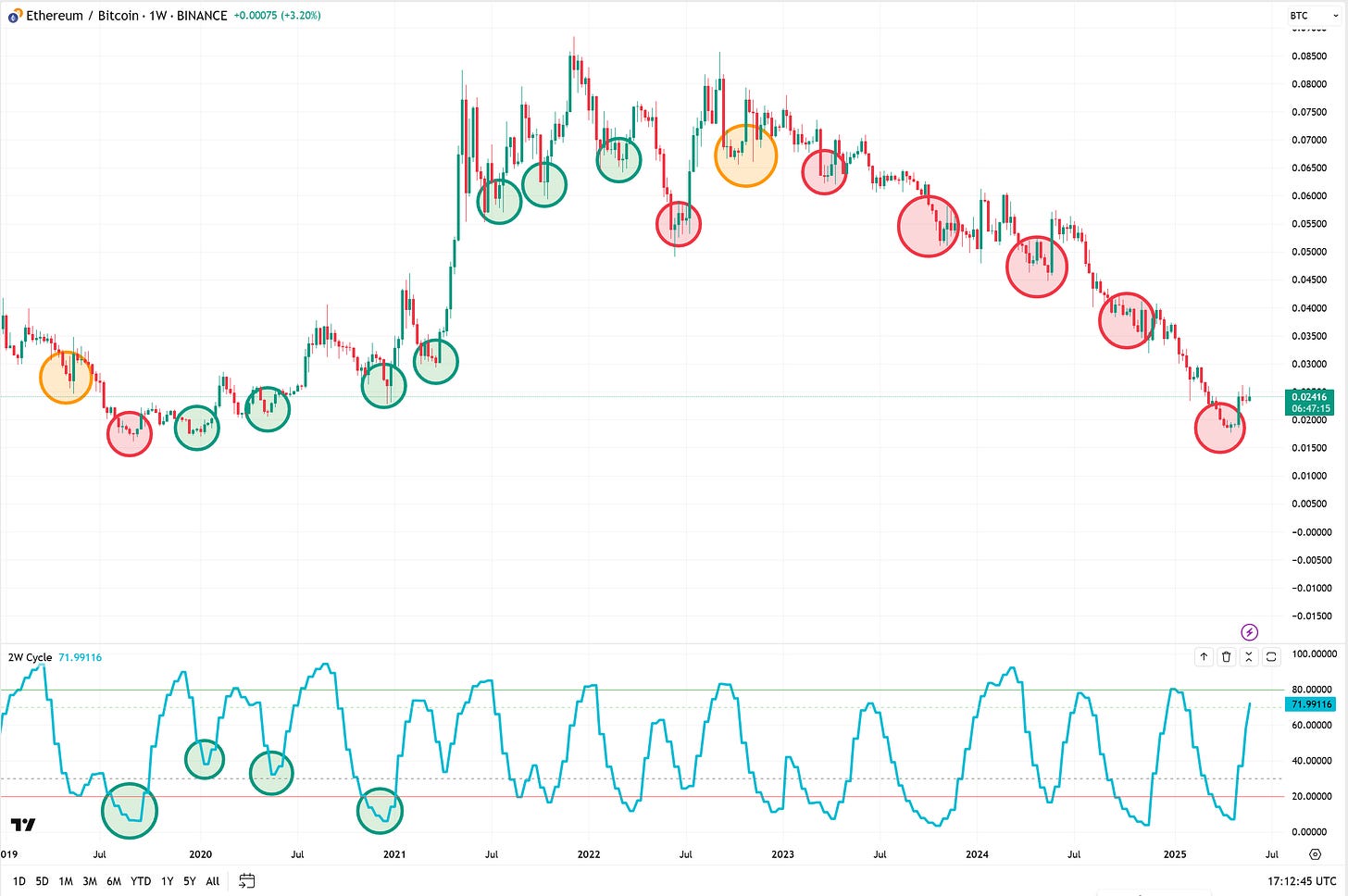

Looking at the ETH/BTC chart, I can already see a shift from bearish to bullish. After five lower lows, we’re starting to build bullish momentum.

Nothing is confirmed until ETH completes the roundtrip and makes a higher high relative to the previous bottom (on the 2-Week Cycle Indicator) — but as Cycle analysts, we act based on probability.

Combine that with:

ETH balancing on an 8-year-long support line

ETH having the highest TVL in the entire crypto space

We're in the third and final year of the bull cycle (where altcoins historically outperform BTC)

…and it’s fair to say ETH is primed to outperform BTC this year.

“That’s great — but what are your entry/exit points for ETH over the next few weeks?”

Here’s how I’m planning to double my money with ETH this summer:

Keep reading with a 7-day free trial

Subscribe to Strategy Master to keep reading this post and get 7 days of free access to the full post archives.