Have you seen the markets this weekend?

Bitcoin has dropped below $99,000, and ETH has fallen under $2,200.

Now you’re asking yourself — how do you even make money in this kind of market?

The reality is: no trading or investing strategy could have predicted this sharp move down.

However, if you’re holding any crypto right now, read until the end — because if you do, you might be the one who profits most from this conflict.

To understand how to benefit from the Middle East event that pushed crypto prices below key support levels, let’s break down what happened in previous, similar situations:

March 2023 – Silicon Valley Bank Goes Under

The second-largest bank failure in U.S. history happened right at the end of a 60-day cycle low. The cycle was extended to 69 days, and Bitcoin dropped below the crucial $20,000 support.

The capitulation lasted only a few days - Bitcoin was trading above $26,000 by March 17.

Similarity to the current situation? Very similar. The 1-week cycle is falling, the 2-week cycle is rising, and both the 3-day and 1-day cycles are showing signs of a bottom, just like back then.

June 2023 – SEC Attacks Coinbase & Binance

The SEC sued Coinbase for running an unregistered exchange and selling unregistered securities. Around the same time, Binance and CZ were charged with multiple securities law violations.

Market reaction? Bitcoin quickly dumped from $27,000 to below $24,000 - hitting another 60-day cycle low. But in the same month, Bitcoin printed a new cycle high.

This news broke the 3-day cycle, causing a one-week-long downtrend, but the market shook it off and reversed higher.

January 2024 – Grayscale Unlock Panic

Grayscale began selling BTC as part of converting GBTC into a spot ETF. Traders panicked, thinking billions in Bitcoin would be dumped.

The market dipped ~20%, with the cycle stretching to 70 days instead of the usual 60.

What happened next? The 3-Day and 1-Week cycles pushed the market to new highs in just a few weeks, and nobody talked about the panic anymore.

August 2024 – Japanese Yen Explosion

The Yen crashed to ¥161 per USD, a 37.5-year low, due to Japan’s extremely low interest rate policy. A surprise 0.25% rate hike by the Bank of Japan in late July caught global investors off guard, forcing them to quickly pull money out of risk assets like crypto and tech stocks, which triggered a wave of panic selling across markets.

Bitcoin dropped below $50K, breaking its previous 60-day cycle low.

But instead of collapsing further, Bitcoin consolidated, reset its key cycles (1-week, 2-week, 3-day), and then pushed higher in the next 60-day cycle.

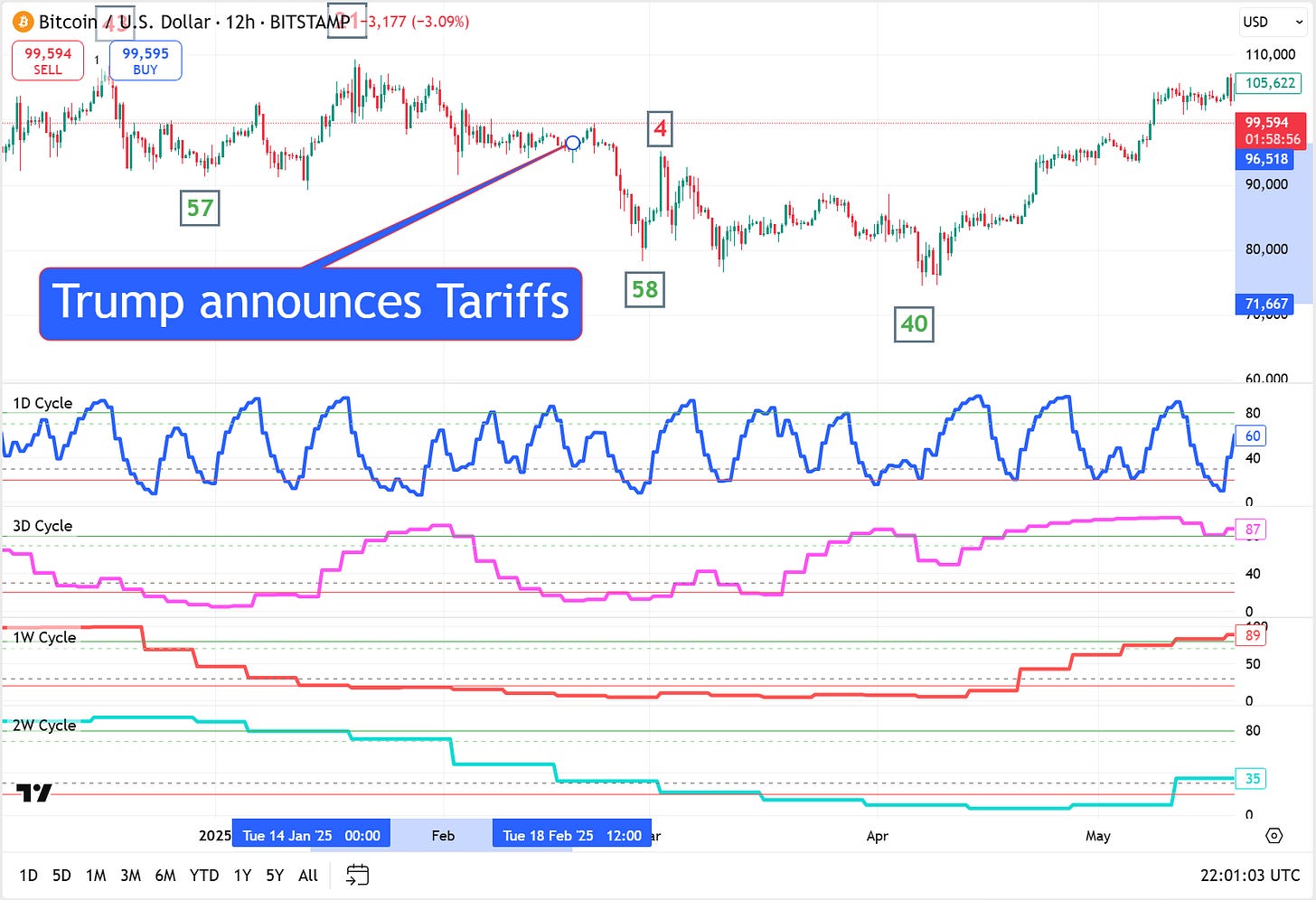

March 2025 – Trump Tariffs & Recession Fears

The Trump tariffs, introduced in February 2025, targeted Chinese tech and EVs. By April, markets feared a full-blown trade war and recession.

The news triggered a failed 3-day cycle and a new low in Bitcoin.

But within weeks, the 2-week cycle took over, and Bitcoin resumed its rally, proving that macro panic is short-lived.

Master, what’s happening with the market right now? Bitcoin is bleeding red candles!

Keep reading with a 7-day free trial

Subscribe to Strategy Master to keep reading this post and get 7 days of free access to the full post archives.